Automating accounts receivable

Our Hyfin integration enables seamless payments, streamlines invoicing, and improves merchant experience with secure, efficient processing.

Streamlines payment processing and invoicing for merchants, enhancing operational efficiency and security

Simplifies transactions while improving cash flow visibility and overall financial management

Delivers fully compliant dual pricing

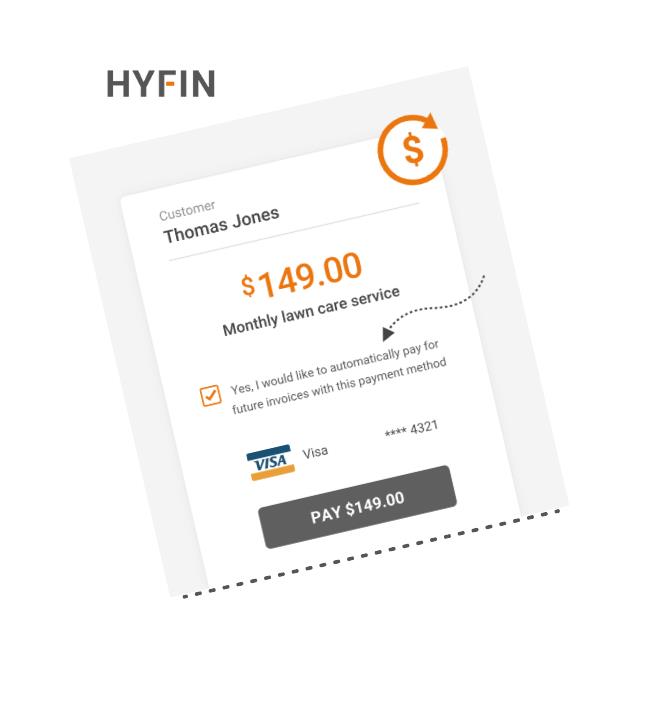

Automates payments, and recurring payment plans

Eliminates slow pay with saved payment methods

Invoices via email, text, or via online payment links

Automating accounts receivable

Our Hyfin integration enables seamless payments, streamlines invoicing, and improves merchant experience with secure, efficient processing.

Streamlines payment processing and invoicing for merchants, enhancing operational efficiency and security

Simplifies transactions while improving cash flow visibility and overall financial management

Delivers fully compliant dual pricing

Eliminates slow pay with saved payment methods

Automates payments, and recurring payment plans

Invoices via email, text, or via online payment links

The Hyfin/linked2pay connection

Our Hyfin integration connects merchants to linked2pay through linked2invoice, which can be white labeled for our ISO partners.

Key features include:

-

Reducing the cost of accepting payment (dual pricing)

-

Available with Level 3 processing

-

Secures same day payment on 85% of invoices

-

Includes multiple features that automates invoicing

Questions & Answers

Here are the most common questions with answers.

1. How does the Hyfin integration work with linked2pay?

It connects the merchant’s linked2pay account directly to Hyfin, automating invoicing, payments, and reconciliation without manual intervention.

2. Does this integration require technical development from the ISO or merchant?

No coding is needed. Merchants authorize their linked2pay account, and Hyfin handles invoicing and payment workflows through a seamless API connection.

3. How does the integration benefit ISOs?

It streamlines payments, reduces manual processing, improves merchant retention, and creates incremental revenue through enhanced ISO service offerings.

4. Can merchants track payments in real-time?

Yes, merchants and ISOs receive real-time updates on invoices, payments, and reconciliations directly from the Hyfin dashboard.

5. Does the integration support multiple payment types?

Yes, it works with all linked2pay-supported transactions, including credit card, ACH, and dual-pricing payments, ensuring full payment coverage.

6. How does this integration improve merchant satisfaction?

By automating invoicing and payment tracking, merchants experience faster processing, lower errors, and simplified accounts receivable management.

Interested, have additional questions? Get in Touch